To read this update in its original PDF format please click here

Memo to: MCJ Capital Partners

From: M. Carter Johnson

Re: Q1 2022 Performance Update

Date: 4/28/2022

Dear Partners & Friends,

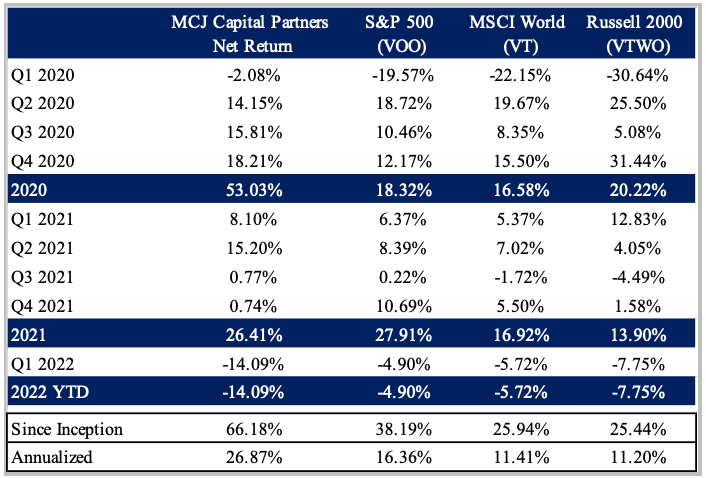

For Q1 of 2022 our total return was -14.09% compared to -4.90% for the broader S&P Index, -5.72% for the MSCI World index, and -7.75% for the Russell 2000 index.[1]

Since inception (as marked February 12, 2020), our total return is +66.18% compared to +38.19% for the broader S&P Index, +25.94% for the MSCI World index, and +25.44% for the Russell 2000 index.

Thoughts and Commentary on Q1 2022

The first quarter of 2022 was filled with macro and geo-political narratives that tossed and turned the prices of even the best companies out there. Record inflation readings, aggressive hawkish comments by the Fed, and of course Russia’s invasion of Ukraine all created whipsawing volatility throughout the three-month period. As it relates to our portfolio specifically, the Russian invasion of Ukraine sparked the largest outflow of European Equities on record. As investors holding small European companies with highly illiquid securities, our positions took a hit. This will happen from time to time. As I’ve mentioned before during our better quarters, our concern is not with the price fluctuations on the marketable securities of our companies, but the fundamentals driving their intrinsic value. Our strategy is not appropriate (and likely never will be) for those in need of constant liquidity and short-term investment horizons. Keeping this framework in mind, I encourage you to embrace volatility and the opportunity sets it brings, even if it feels a bit uncomfortable. On occasion, you should expect drawdowns that exceed this amount on both an absolute and relative basis.

In the first three months of 2022 we increased exposure to some of our better ideas and entered a few new positions that I will detail at a later time. At the present moment, markets seem fixated on apparent headwinds 6-12 months out, which will have little impact on the true intrinsic value of companies in 3-5 years. For long-term investors, these are ideal environments.

Commentary on Our Companies

Seeing as our European positions took the greatest hit this quarter, I find no better opportunity than to update you on some of our “worst” performers.

If you recall in our Q3 2021 update I wrote about Creightons PLC and explained why a falloff in hygiene sales would send short-term investors and the market for Creightons shares into an overall tizzy. Well, as expected, Creightons reported a complete drop off in hygiene sales. Somewhat unexpected was that the hygiene fall-off was almost completely covered by the rapid increase in branded sales and contributions from the Emma Hardie and Brodie Stone acquisitions. Nonetheless, shares of Creightons have slid more than 55% from their high of 136 pence set in September of 2021, presenting a fabulous opportunity for owners like us to add to our position.

What’s next for Creightons? Studying serial acquirers, one of the inflection points we look for in small up-and-comers is when a company can support the overhead to justify an in-house M&A position (beyond just the executive team). This gives the company an opportunity to systematically ramp proprietary deal flow while reducing both distractions for management, and the inevitable bidding wars brought by broker-oriented deals. Recently, Creightons added Gary Armstrong to their team, and have stated the objective of securing two acquisitions in the 2022 calendar year. Even if Creightons fails to secure a single acquisition in 2022, we’re happy with the organic growth prospects of the company as they transition sales and distribution to online retail platforms. Looking 3-5 years out, Creightons has all the ingredients to ride the twin engines of earnings growth and valuation expansion.

Keeping in the UK, let me introduce you to a company we’ve held for a few years but I’ve never publicly written about – Judges Scientific PLC. Judges Scientific was another company with shares that took a hit. The company trades on the AIM, making shares held for more than two years exempt from inheritance tax for UK investors. As a result, the company has a stronger long-term focused shareholder base with lower turnover that resembles almost that of a private company. Shares were as high as 8,800 pence in January before cratering to 6,090 in early March. Again, it’s not the share price that is our concern, it’s the intrinsic value. On March 23rd, the company reported double-digit topline and earnings growth compared to its two-year stack (pre-pandemic reporting period). Shares have since rallied and recovered half of their earlier price declines. Regardless of share movement, let’s talk about why we like the company...

Judges Scientific was founded in 2002 by a value-oriented investor, David Cicurel (who is the current CEO). Leaning on his turnaround experience, Cicurel had planned for Judges Scientific to take active positions in poorly ran companies with the goal of arbitraging private and public market valuation discrepancies. As valuation spreads tightened, Cicurel landed on a different strategy, deciding to “buy and build” great companies with favorable long-term growth prospects. The company identified the scientific instrument industry as a favorable niche in which they could acquire and provide retiring operators with a permanent home for their company.

The scientific instrument market is a fabulous niche for a serial acquirer. Often founded by doctorate-level individuals, these businesses typically operate as standalone entities until the founder is in need of a retirement exit. Demand across the industry is driven by regulatory and standardization requirements along with the never-ending drive of commercial product optimization. The industry benefits from an arms race of sorts, where any new measurement capability leads to a necessary purchase by customers. Customers who delay equipment upgrades risk being limited to dated technical capabilities that fall short of the latest significant scientific measurement or new regulatory requirements. As a result, scientific instruments are routinely sold to universities, OEMs, Industry-leading brands, and research and compliance entities. If there’s any critique about the space, it’s the cyclical nature that comes with being tied to Research and Development that at times leads to reduced Capex spending in economic downturns (although this is typically offset with a “catchup” in purchases during recovery periods). Judges Scientific focuses on acquisitions of these types of businesses in the UK market, where there are approximately 2,000 targets. Each year roughly 5% (or 100) of these businesses are up for sale. Judges Scientific is of the Goldilocks size where just one acquisition can move the needle, yet no single acquisition makes or breaks the company. Since 2005 the company has completed 19 acquisitions.

Cicurel and team have demonstrated their ability to be disciplined capital allocators. By design, Judges Scientific targets UK businesses (a geography with favorable multiples compared to the US), with less than £1 Million EBIT. This keeps acquisition multiples between 3-6x EBIT. When Judges Scientific buys a business, the company typically borrows up to 2.5x EBITDA. However, because of Judges Scientific’s cashflow diversification at the portfolio level, and its permanent equity base, the company can borrow at lower rates and better terms than a traditional private equity firm. In addition, Judges Scientific limits acquisition risk by focusing on small deals while maintaining the diversified base of unrelated collective companies at a portfolio level. As a result, Judges Scientific has an impressive machine in place to reallocate earnings at a high rate of return (something we covet at MCJ Capital Partners).

Once acquired, Judges Scientific integrates the company at a portfolio level. One of the first items of execution is installing robust financial controls that standardize reporting and drives comparable accountability of the newly acquired entity as compared to the other Judges Scientific companies. Leadership is encouraged to interact with fellow portfolio company peers and lean on best practices that have improved organic growth across all portfolio companies. However, for the most part, leaders of acquired companies are mostly left to run the day-to-day business in a truly decentralized manner. On an operational front, in 2017 Judges Scientific landed Halma PLC veteran Mark Lavalle as Chief Operating Officer. Halma is another phenomenal serial acquirer, albeit about 15x the size of Judges Scientific. If you’re familiar with the culture of Halma, you’ll understand why having Lavalle as the COO is advantageous at this point in Judges Scientific’s history.

Overall, we’re pleased to own such a great company as Judges Scientific and welcome bouts of market volatility that allow us to scoop up more shares.

Closing Thoughts

As you may or may not be aware, I keep an eye on private markets for unique opportunities and to understand more of what’s in the pipeline for some of our serial acquirers. From my perspective valuations are beginning to come down in private markets, resembling a similar fade we’ve seen in public markets that started late Q3 of last year. In addition, conversations I’ve had with debt side financing have carried a much more cautious tone towards underwriting deals. I believe circumstances of this nature play well for acquisitive permanent capital bases such as Creightons, Judges Scientific and many of our portfolio companies. As to what happens in the short-term is anyone’s guess. We’ll keep focusing on finding good businesses at fair prices.

Until next time,

M. Carter Johnson

1) The performance results shown are those of the first account under management of MCJ Capital Partners LLC (“MCJ”) and are the result of the application of MCJ’s proprietary investment process. These performance results are presented net of all fees including brokerage, margin, custodial, and a 1% management fee beginning in January 2021. No management fee was charged in 2020, all other fees were present. A client’s return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account, including advisory fees in the future. The performance results include the reinvestment of dividends and interest on cash balances where applicable.

All performance results are unaudited and are not an estimate of any specific investor’s actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment. All information provided is for informational purposes only and should not be deemed as advice in relation to legal, taxation, or investment matters. Past performance is not indicative of future results.

Each of the S&P 500 Index, the MSCI Index, and the Russell 2000 Index (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance, and its performance is not reflective of the performance of any specific investment. The Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of an account managed by MCJ and each Index may not be comparable. There may be significant differences between an account managed by MCJ and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index. The S&P Index return was determined using the performance of Vanguard S&P 500 ETF (VOO). The MSCI Index return was determined using the performance of Vanguard Total World Stock ETF (VT). The Russell 2000 Index return was determined using the performance of Vanguard Russell 2000 ETF (VTWO).

MCJ offers investment advisory services and is registered with the state of Colorado. Registration does not constitute an endorsement of the advisory firm by the Colorado Securities Commissioner nor does it indicate that the advisory firm has attained a particular level of skill or ability. All content on this webpage is general in nature, not directed or tailored to any particular person, and is for informational purposes only. Neither this webpage nor its contents are offered as investment advice and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. In addition, neither this webpage nor its contents should be construed as legal, tax, or other advice. Individuals are urged to consult with their own tax or legal advisers before entering into any advisory contract.

The information contained herein reflects the current expectations and opinions of MCJ as of the date of publication, which are subject to change without notice at any time. MCJ does not represent that any expectation or opinion will be realized. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Neither MCJ nor any of its advisers, officers, directors, or affiliates represents that the information presented in this tear sheet is accurate, current or complete, and such information is subject to change without notice. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment.

Past performance is not indicative of future results.

Additional information is available from MCJ upon request. MCJ is not acting as your adviser or agent unless and until you and MCJ sign an investment advisory agreement.

Readers are advised that the material herein should be used solely for educational purposes. This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. MCJ Capital Partners LLC does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. MCJ Capital Partners LLC will not be liable for any loss or damage caused by a reader's reliance on information obtained in any of our newsletters, presentations, memorandums, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters, presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions.

MCJ Capital Partners and accounts actively managed by MCJ Capital Partners have long positions in Creightons PLC (CRL), Judges Scientific PLC (JDG.L), and would benefit from overall price appreciation of the stocks. At any time we may close any of these position without notice.